Bucks:Expense & Budget Tracker

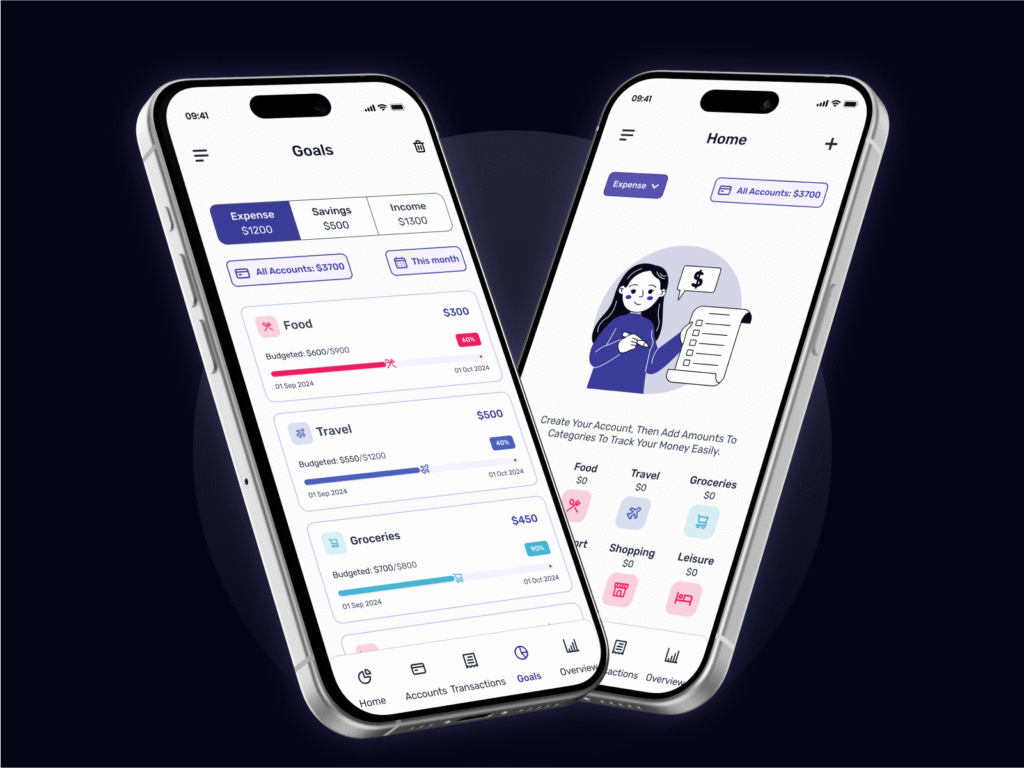

Take control of your money with ease. Managing finances can feel overwhelming, but our all-in-one expense tracker and budget planner simplifies the process. Track your spending, manage savings, and gain financial clarity all from your phone.

Project Goal

We designed a finace app that fits seamlessly into your daily routine, making money management effortless. With clear insights and smart tracking, you can make informed decisions, stick to your budget, and reach your savings goals faster.

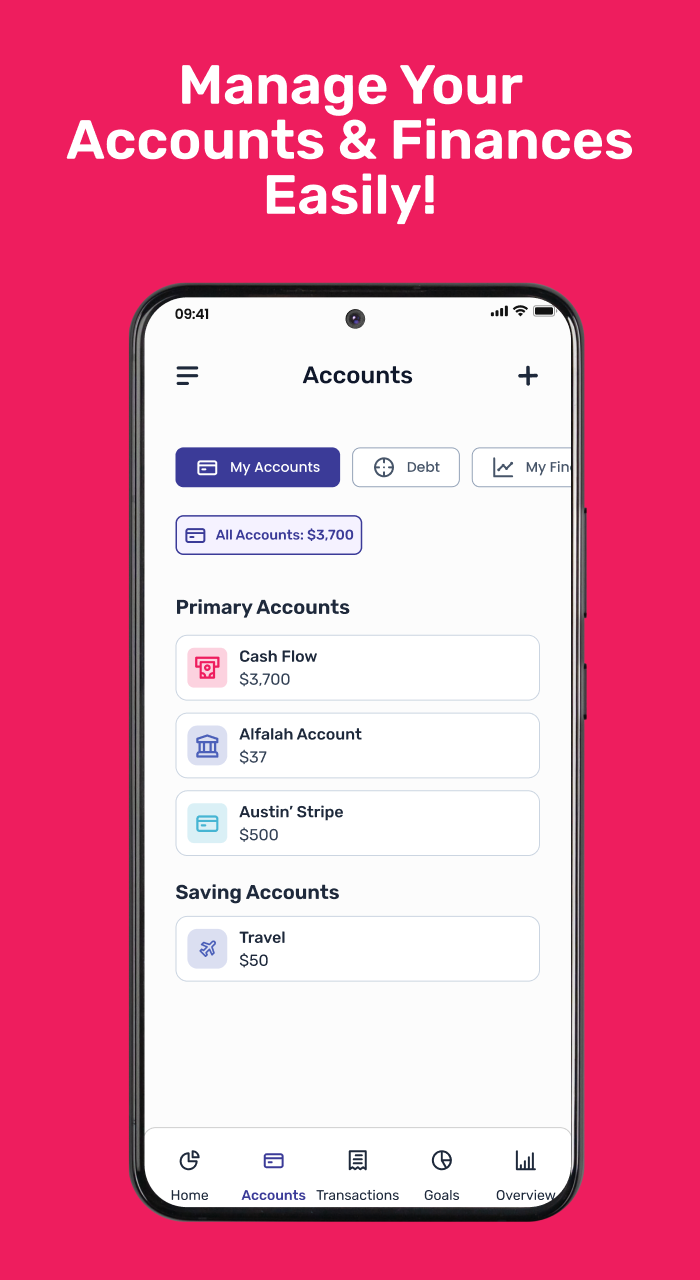

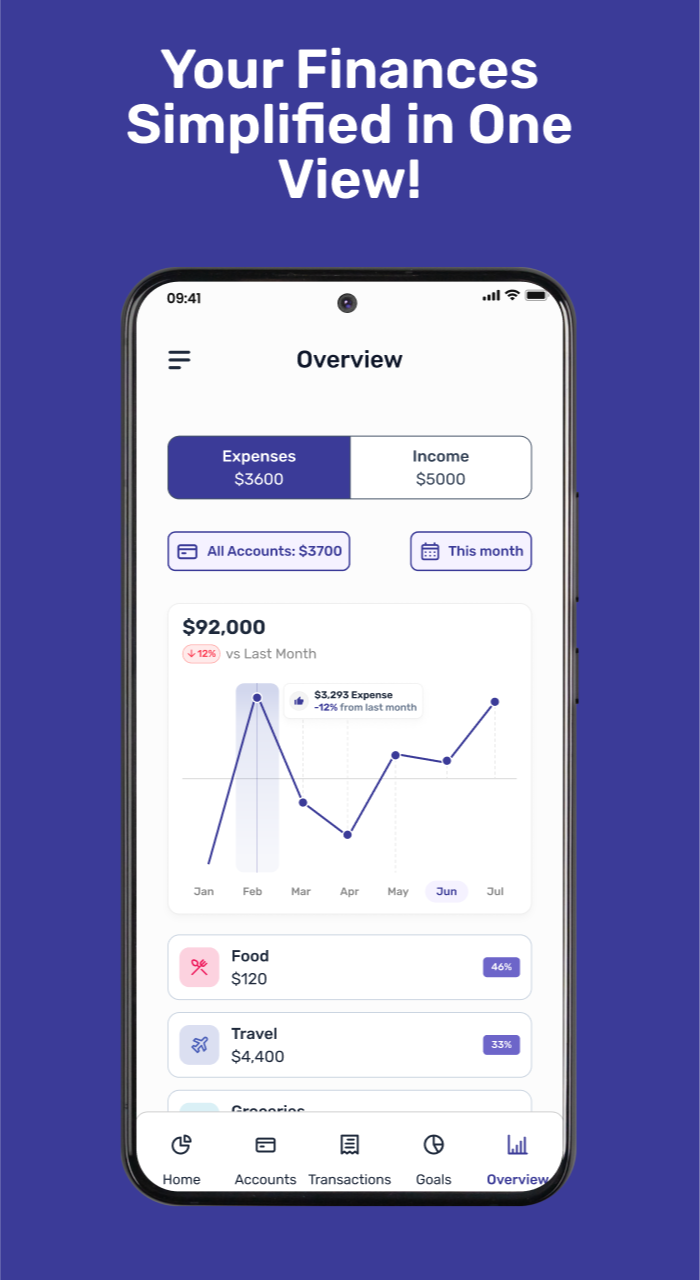

Manage Everything in Your Hand

Keep your finances organized in one place with real-time updates that help you stay on top of every earning.

User Friendly

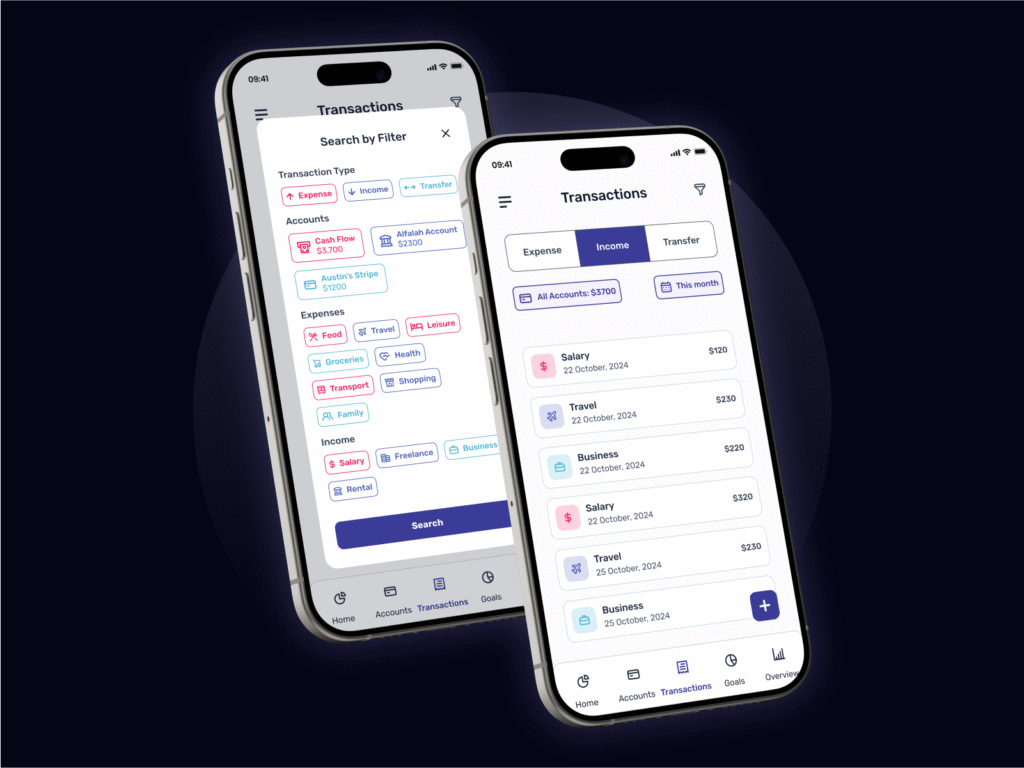

Record transactions in seconds with a quick-entry system designed for busy lives. Just swipe, tap, and there you go.

Best Support

Get helpful tips and responsive assistance whenever you need guidance on budgeting or using advanced features.

Secure

Our bank-level encryption ensures your financial information remains private and accessible only to you.

We are working in multiple Categories

Our app covers different aspects of personal finance to give you complete control over your money management.

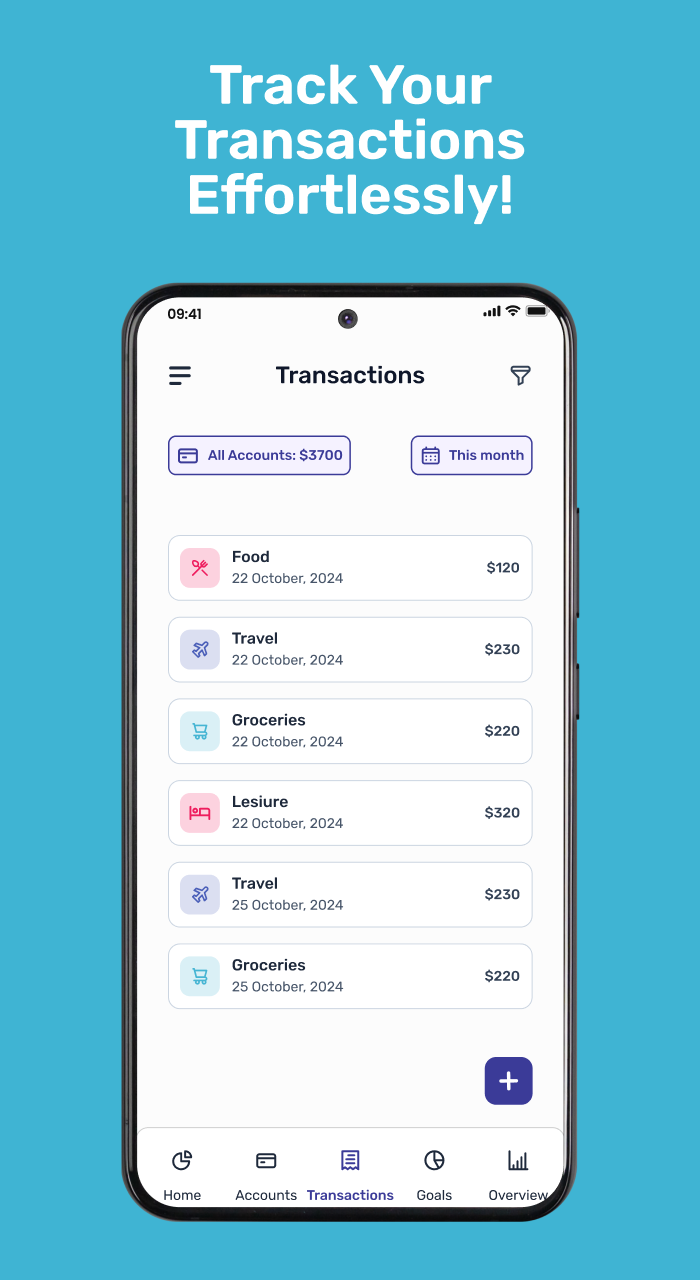

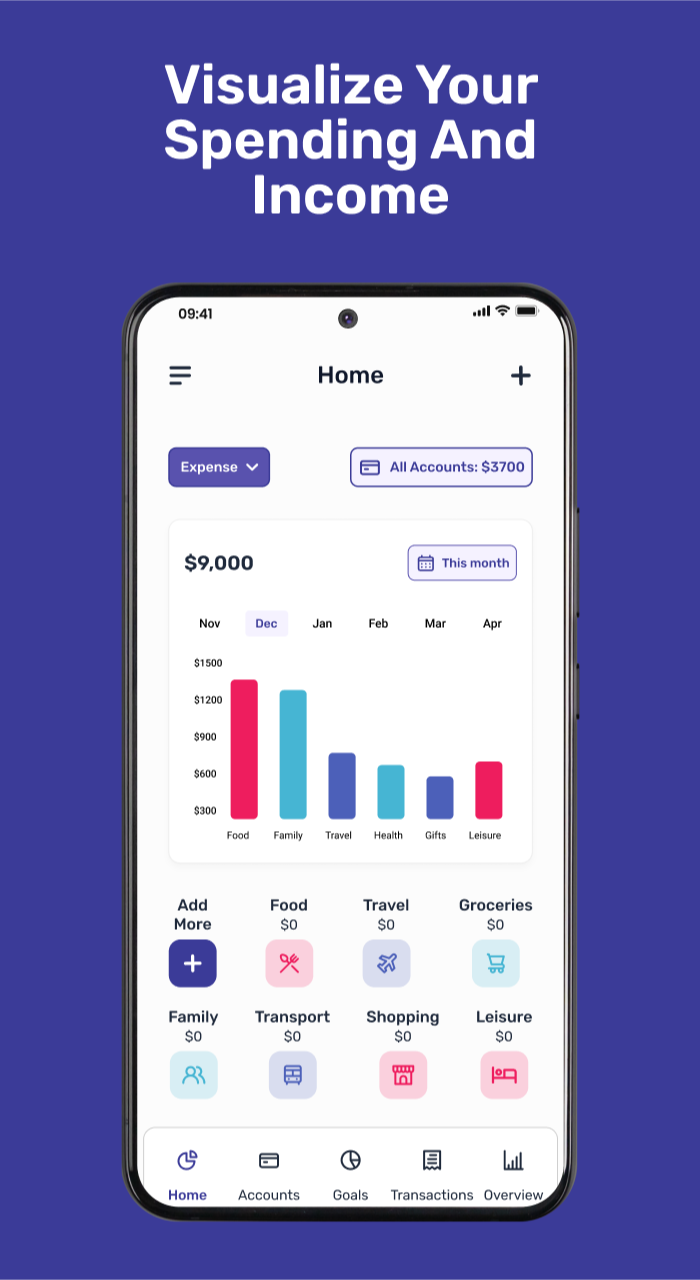

Daily Expense Tracking

Capture spending instantly with customizable categories that adapt to your lifestyle and spending habits.

Budget Planning

Create realistic spending limits that adjust with your needs and receive gentle alerts before you exceed them.

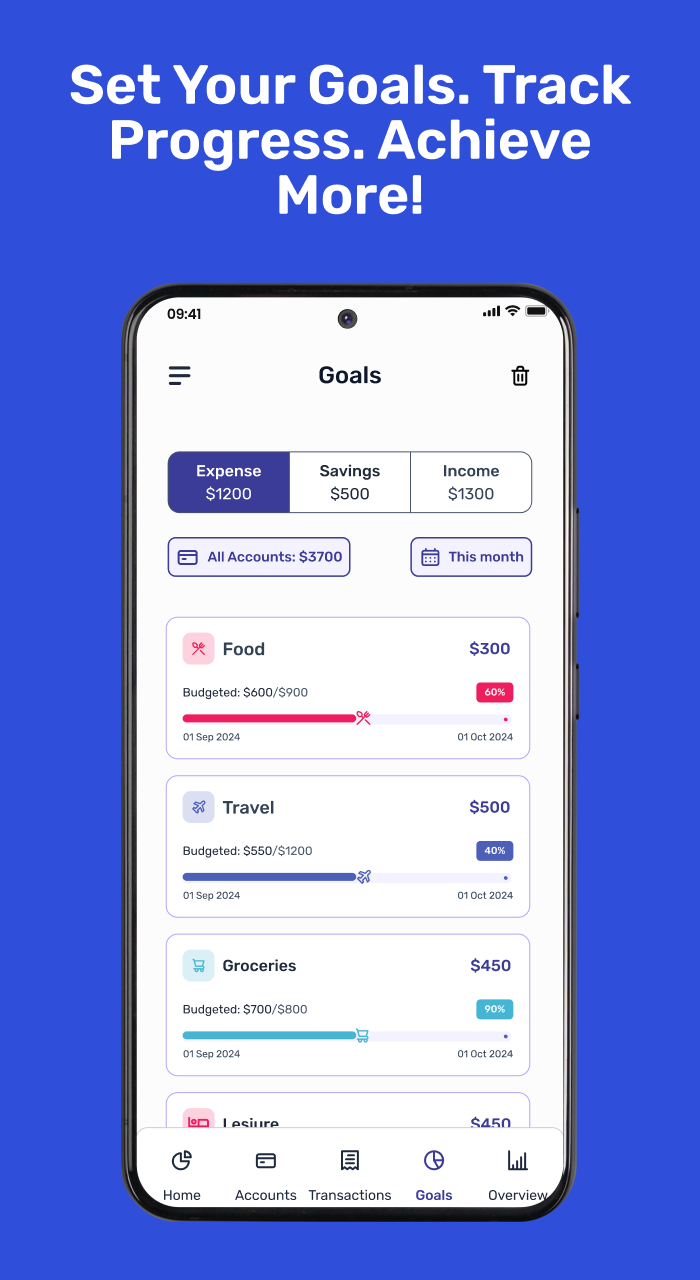

Financial Goals

Track progress toward savings targets and debt payoff milestones with visuals that keep you motivated.

- Challange

- Solution

- Impact

Most people struggle to understand where their money goes each month, leading to financial stress and difficulty saving. Traditional budgeting methods are time-consuming and often abandoned.

Our app automatically categorizes spending and provides visual breakdowns that highlight financial patterns. The intuitive interface makes recording transactions effortless, while customizable alerts help users stay on budget before overspending occurs.

Users typically discover that 15 to 20 percent of their income goes to unexpected categories, allowing them to reclaim those funds for savings or debt reduction. The app’s simple and effective approach has helped people maintain better budgeting habits, with 78 percent of users still actively tracking their finances after six months.

Technologies We Leverage

Building

Smarter App